CUSTOMER CASE: Europabank

Project scope:

- Development of a data hub

- Development of the budgeting and forecasting processes of Europabank’s NII activities

- Development of reporting and analysis functionalities and UX pages

- Collection of the forecasted NII calculations to the P&L and balance sheet

- Train members of Europabank’s financial controlling team to become acquainted with model building in Anaplan

Europabank, a Belgian bank which is a member of the Crelan Group, was looking for professional support in order to be able to build its first model in Anaplan. Europabank envisioned that its Net Interest Income (or NII) forecasting processes that had previously been executed in excel sheets, could be executed faster and in greater detail in Anaplan. For these reasons, it consulted ACCTER for support in an Anaplan project of which the aim was twofold.

The first part of the project scope was to create an NII model with accompanying data hub and reports that is customized to Europabank’s specific needs. More specifically, the model needed to incorporate Europabank’s specific business logic and processes, its own mappings and assumptions, its own data and accounting framework and its own reporting framework. Anaplan offers the flexibility to allow for this degree of customization and ACCTER as a boutique Anaplan partner strives to meet its customer’s specific requests.

The second part of the project scope consisted of the development of Anaplan expertise at Europabank. Thanks to this investment in expertise on Anaplan Europabank was able to take over the daily maintenance of its model after project completion and to manage the evolution of its model by changing, adding or deleting parts when the need occurs.

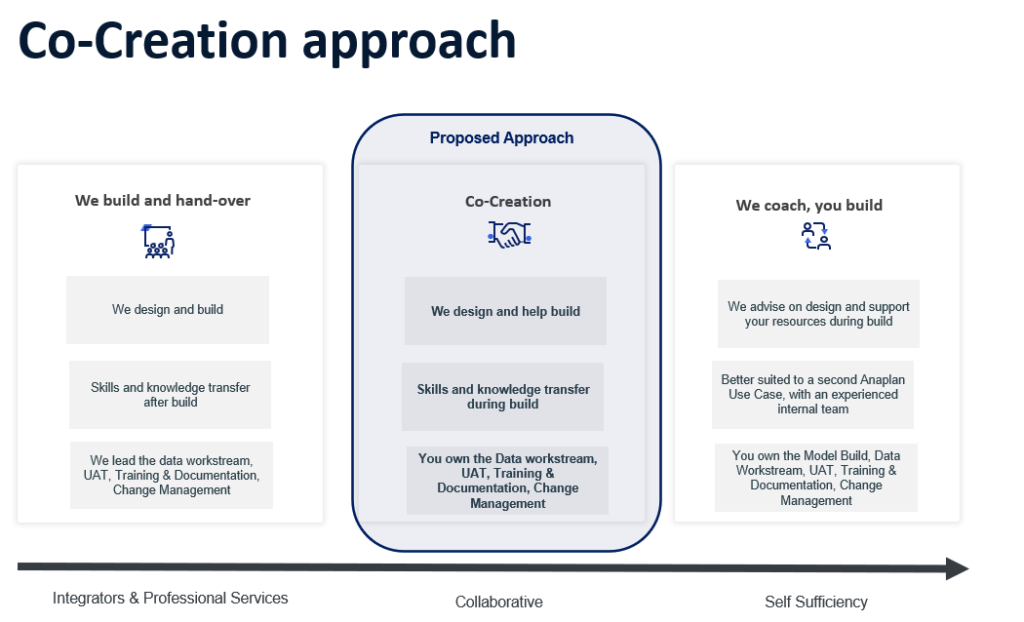

In general, ACCTER offers its customers the possibility to choose between three different approaches to handle a project. These three different approaches are visualized in the overview below. What option is chosen can depend among others on how much time the customer’s stakeholders can make available and how much Anaplan expertise is already available among the customer’s staff.

In the case of Europabank ACCTER proposed to opt for the Co-Creation approach since this approach is perfectly suited to assist Europabank’s stakeholders in developing the right Anaplan skills. As a first step Europabank identified as model builders employees with great understanding of the NII forecasting processes, who were very eager to adapt to the Anaplan way of working and who acted as ambassadors of the new Anaplan model after project completion.

As a second step detailed and well-written user stories were formulated. These user stories were used as a guide during the model build to understand the requirements correctly. At the same time we started to focus on what was needed to lay the foundations of Europabank’s data hub. The data hub of an Anaplan model gathers, structures and validates the source data before it is sent to the spoke model(s). Within the project scope it was foreseen that the data hub feeds solely the NII model, but the data hub can serve to feed other spoke models as well when Europabank decides to enlarge its current model.

An important aspect of the build of a data hub is a thorough inspection of the data files that are to be imported into the data hub. We have therefore invested the necessary time and attention to the structure of the data files and the quality and structure of the data therein. Points of potential improvement were communicated and discussed with Europabank’s stakeholders during meetings and via the “The Anaplan Way” or TAW app we had set up in Europabank’s workspace. This app facilitated the communication concerning decisions made and the follow-up of the progress on open action points.

In the next phase of the project we embarked on co-building the NII-model together with Europabank’s employees who had been selected as model builders. At this stage they had already successfully completed the level 1 Anaplan training via Anaplan’s e-learning courses. The level 1 training offers an introduction to the basics of Anaplan. Anaplan also offers level 2 and level 3 e-learning courses to explain the more complicated aspects of model building. However, the downside of these trainings is that trainees have to apply the technical Anaplan skills in a supply chain and a sales context for a candy production company. This kind of knowledge is not necessary for constructing an NII model for a bank. We therefore organized customized on-site training sessions in Europabank’s head office in Gent to explain the principles of Anaplan model building. As such we assured they only got in touch with the Anaplan logic and formulas which are needed for a well-functioning NII model. In this way we offered a more agreeable learning experience to Europabank’s model builders and we allowed them to save valuable time which they could use to focus on their other obligations. Another advantage of this approach was that Europabank’s model builders offered us immediately feedback with more concrete explanations of their business processes or with potential improvements to what we had already built.

To conclude the project we connected the calculated forecasting

results with Europabank’s P&L and balance sheet actual data and

created several P&L and balance sheet reports for the different

stakeholders of Europabank. We customized the reports such that they are

constructed according to the specific reporting format of each

stakeholder. We also added reports that allowed to compare the

calculated forecasting results with those of previous budgeting or

forecasting exercises as well as with actual data. Finally, we developed

detailed calculations for PQM reporting.

In the end all of our collective efforts resulted in multiple

benefits for Europabank. One of them is that Europabank had used the

opportunity to implement improvements: accounting lists were updated,

forecasting calculations were scrutinized and improved, reports received

an update and a greater level of detail and extra functionalities were

introduced. Anaplan features such as KPI’s and graphs were added to

support the business information. Tasks that previously needed to be

performed manually, were automated. Finally, we also take pride in

having constructed the NII model in such a way that it only requires

minimal space in terms of GB in Europabank’s workspace. This leads to

beneficial cost savings for Europabank and gives room to enlarge their

Anaplan model in the future.

For more information contact us: hello@accter.be