Abacum

Abacum is the AI-native FP&A platform that helps finance teams plan smarter, move faster, and make confident decisions. By embedding intelligence directly into core workflows, like data consolidation, forecasting, scenario planning and reporting, Abacum transforms financial planning from a manual, time-consuming process into a strategic advantage.

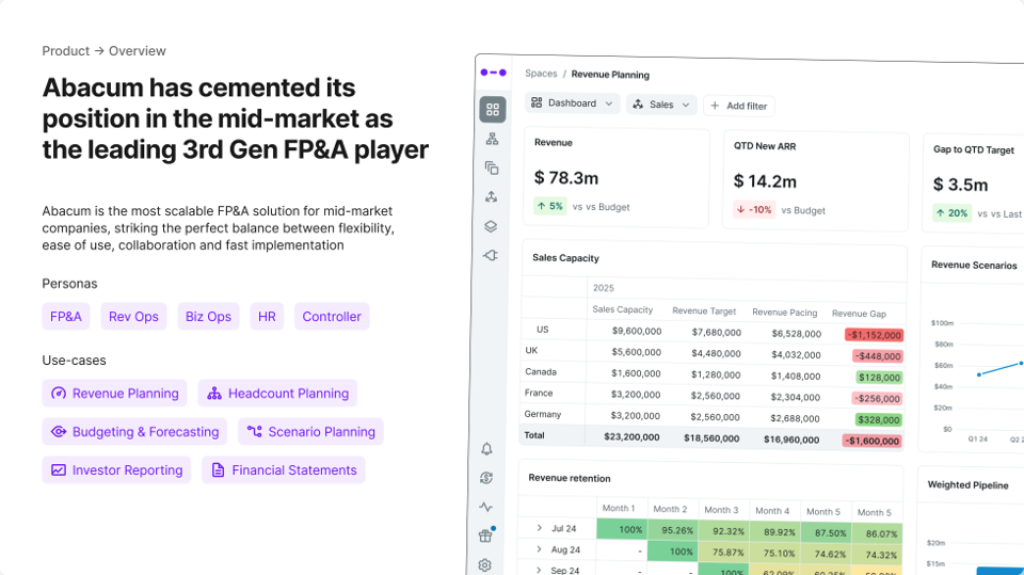

Revenue Planning

Revenue Planning

Abacum is an AI-native FP&A platform built for revenue planning, helping finance, RevOps, and FP&A teams move from spreadsheets to structured, data-driven models. It supports top-line growth through forecasting, scenario planning, and modeling tools.

- Key benefits:

- Revenue forecasting: Real-time tracking with both top-down and bottom-up planning.

- AI-assisted modeling: Build custom models quickly with smart formulas and autocomplete.

- Scenario testing: Explore “what-if” cases to assess risks and sensitivities.

- Centralized planning: Combine revenue, quota, and capacity planning in one place.

- Features:

- Revenue forecasting

- Sales capacity planning

- Cohort analysis

- Sales quota planning

Headcount Planning

Abacum presents itself as an AI-native FP&A platform designed for headcount planning, helping finance, HR and department leaders move from isolated spreadsheets to a unified, strategic workforce-planning process. The tool supports aligning staffing and budget decisions with business outcomes.

- Key benefits:

- Align headcount to strategy: Create workforce plans that tie hires, open roles, and costs to business goals.

- Plan and manage all workforce changes: Set budgets, forecast hires, track open requisitions, and reconcile actuals in one platform.

- Centralised approvals and workflows: Streamlines the approval process for role-changes or new hires, reducing time and effort.

- Features:

- Workforce budgeting

- Role forecasting

- Open-role reconciliation

- Approval workflows for staffing changes

Budgeting & Forecasting

Abacum’s platform for budgeting & forecasting enables finance teams to replace manual spreadsheets with structured workflows, helping them build faster forecasts, set detailed budgets, and adapt plans in real-time.

- Key benefits:

- Faster forecasting: Uses pre-built templates to speed up the budgeting cycle and increase stakeholder accountability.

- High granularity: Budgets can be set down to the vendor or customer level, or grouped as needed.

- Real-time adaptation: Models can roll forward, reforecast key metrics, and respond to changing conditions.

- Scenario modelling: Build multiple versions of budgets/forecasts and test “what-if” outcomes.

- Features:

- Budgeting at multiple levels

- Forecasting across business units

- Versioning of plans

- Detailed scenario analysis

- Collaborative workflows for finance teams

P&L, Balance Sheet, Cash Flow

Abacum’s module for P&L, Balance Sheet & Cash Flow (BS & CF) enables finance teams to consolidate, model and report all three key financial statements in a single platform.

- Key benefits:

- Unified consolidation: Combine data across multiple entities and currencies; automate FX adjustments to simplify multi-entity/month-end consolidation.

- Real-time visibility: Get live access to P&L, BS and CF statements, with drill-down and variance analysis.

- Enhanced month-end cycle: Shorten reporting time and increase accuracy by removing fragmented spreadsheets and manual FX entries.

- Features:

- Multi-entity financial consolidation

- Automating month-end statement production

- Real-time financial performance monitoring across statements

- Drill-down analysis of profit, assets/liabilities, and cash flows

“At ACCTER, we strongly believe that 3rd-generation FP&A tools for the mid-market can deliver tangible value while natively embedding AI. We’re genuinely impressed by how AI elevates both our work as a partner and the day-to-day tasks of end users and customers.”

Brent Hoskens